Nonprofit Accounting Services Not-For-Profit Accounting Firm

Prime 10 Erp Methods And Software For The Manufacturing Trade

October 25, 2023$one Dollar Bank Internet based Gambling houses On Canada

November 9, 2023

Contact us now to find out how Raymond H Best, PC, CPA can help you manage the financial side of your nonprofit. Churches, mosques, temples, and other faith-based organizations are important components of every neighborhood. If you sell a capital asset for a profit, your capital gain is the difference between what you sold it for vs. your purchase price. For example, Your office furniture investment valued at cost basis is $750, and the current fair market value for the property is $2,000. Our hands-on onboarding process includes a detailed kick-off meeting, weekly check-ins for 8-10 weeks, account setup, records review, audit-ready workbooks, and seamless transition to our Client Services Team. Jitasa’s Nonprofit Controller nonprofit accounting services Services ensure your financial world keeps turning with precision and confidence.

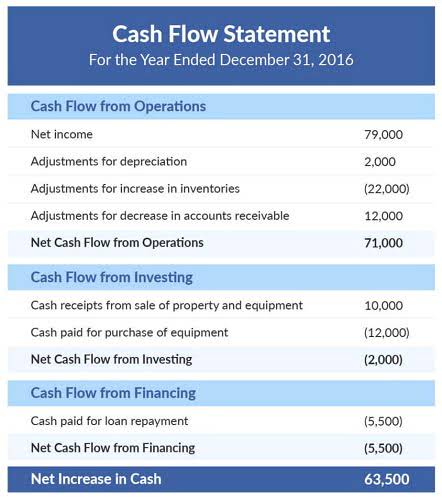

Develop annual budgets and cash-flow forecasts to manage uncertainty

As we step into 2025, the importance of cybersecurity for nonprofit organizations cannot be overstated. The digital landscape is fraught with evolving threats that pose significant risks to the operations, reputation and financial stability of nonprofits. Supreme Court have significant implications for nonprofit organizations that rely on federal funding. A series of legal battles over the executive branch’s ability to halt federal disbursements have created uncertainty, affecting organizations with government grants and contracts. W&D’s Not-for-Profit Team has knowledge of federally and state sponsored programs, which is an important factor in our ability to service not-for-profit organizations.

Focus on proactive financial planning

We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a customized solution that is not only cost-effective but also strengthens your accounting function. Properly tracking and reporting accounting transactions ensures financial transparency and helps earn the trust of stakeholders.

BDO USA Teams Up with Olympian and Pro Golfer

- You have real-time access to your books and tailored grant financial statements.

- Nonprofit organizations serve a unique purpose in society, often focusing on charitable, religious, educational, or social causes rather than generating profits.

- Our Operational Excellence team applies Lean Six Sigma principles to analyze your processes and develop sustainable solutions that work for you.

- Our nonprofit professionals are highly educated in the regulations, reporting standards, and evolving challenges nonprofit organizations face.

- We’ve maintained a great reputation from day one because we focus on doing the simple things right.

By teaming with partners like Velocity Advisory Group, local businesses and community leaders, we provide the most thorough and practical instruction for you and your nonprofit. We’ll show you how to stay in compliance with employment regulations and protect your organization from costly penalties. We can also help you find and retain qualified personnel so you can serve your community.

Health and Human Servicesadd

This article provides CFO’s and other higher education C-suite leaders with a breakdown of the bill’s provisions and the potential impacts on their institutions. The U.S. House of Representatives narrowly passed a nearly $4 trillion tax bill, advancing it to the Senate where significant changes are anticipated. The bill, a major step in the reconciliation process, includes adjustments such as increasing the SALT deduction cap and modifying energy credits.

Their high-level services include annual budgeting, cash flow projections, and assistance in preparation for external annual audits. Meanwhile, the day-to-day support they offer includes the management of immediate cash needs and internal control evaluations. Therefore, having access to a knowledgeable individual to dive into these needs can be a valuable resource, especially if you have one very specific aspect of your strategy that you need assistance with. We love Paro because they’ll facilitate this matchmaking process to ensure your nonprofit has access to the right financial expert for your needs. Quatrro will help your organization with all of your internal management needs. When you employ technology to compile new financial and organizational data, Quatrro can provide support ensuring all of your technology works together seamlessly.

Outsourced bookkeeping for nonprofits brings an external layer of oversight Bookkeeping for Consultants and ensures strong internal controls are in place. External bookkeeping services to nonprofit organizations offer regular audits, segregation of duties, and fraud prevention measures, minimizing the risk of financial mismanagement. In the bustling heart of New York City, where ambition meets opportunity, nonprofits navigate a landscape as dynamic as the city skyline.

Our expert team then devises a customized plan to address your specific needs and challenges. Our team conducts a comprehensive financial analysis and works closely with nonprofit leadership to develop strategic financial plans. Chazin provides in-depth industry knowledge that allows us to provide strategic guidance related to finance, accounting, technology, and how to best protect your organization against internal and external threats. Balance sheets, tax forms, and payroll management can be time-consuming but are essential for any nonprofit. Finances can feel overwhelming — but they’re essential to your organization’s health and longevity. In this episode of What the Fundraising, we demystify the numbers behind your mission and talk all things nonprofit business.

- As a nonprofit organization, you face unique challenges that for-profit businesses don’t, such as the annual submission of Form 990, compliance with (OMB) Circular A-133 requirements or paying taxes on unrelated business income.

- After helping more than 250 nonprofits with accounting, tax, audit, HR, technology and other services, we can provide you with an experienced perspective.

- Your message has been received and we’ll be reviewing your request shortly.

- Transaction volume has also increased so much that the founder may not have the time to keep up.

At Nimbl, we understand that nonprofit finances are about more than just numbers — they’re about making an impact. Whether you need help with day-to-day bookkeeping, preparing for an audit, or navigating complex grant reporting, our nonprofit accounting services help you stay focused on what matters most. Our team specializes in the nonprofit industry, so we know the ins and outs — from tracking restricted funds to ensuring compliance with balance sheet ever-changing regulations.