Double Entry Accounting Definition & Examples

iOS-?????????: ??? ??, ??? ?????????? ?? ?? ??? ????? NIX

May 8, 2020What is a Contra Account? Types & Examples Explained

July 27, 2020Content

Recording transactions this way provides you with a detailed, comprehensive view of your financials—one that you couldn’t get using simpler systems like single-entry. If there is a mismatch in the records, it is quick enough for accounting professionals to identify errors and rectify the same. DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. Expense accounts show money https://www.bookstime.com/ spent, including purchased goods for sale, payroll costs, rent, and advertising. Income accounts represent money received, such as sales revenue and interest income. Peggy James is an expert in accounting, corporate finance, and personal finance. She is a certified public accountant who owns her own accounting firm, where she serves small businesses, nonprofits, solopreneurs, freelancers, and individuals.

Using the Accounting Equation in Your Small Business Bookkeeping – The Motley Fool

Using the Accounting Equation in Your Small Business Bookkeeping.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

In accounting, the duality concept, also known as the dual aspect concept, refers to how each transaction made affects a business in two aspects. The double entry double entry accounting accounting method is based on this concept of duality. The double entry system is more organized and helps assess the overall financial scenario of a company.

Examples of Accounts

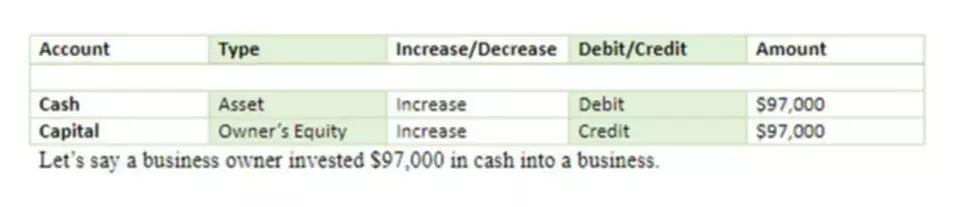

Because the first account was debited, the second account needs to be credited. Common stock is part of stockholders’ equity, which is on the right side of the accounting equation. As a result, it should have a credit balance, and to increase its balance the account needs to be credited. On December 1, 2021 Joe starts his business Direct Delivery, Inc. The first transaction that Joe will record for his company is his personal investment of $20,000 in exchange for 5,000 shares of Direct Delivery’s common stock. Direct Delivery’s accounting system will show an increase in its account Cash from zero to $20,000, and an increase in its stockholders’ equity account Common Stock by $20,000.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Our company was able to raise $1 million in cash, reflecting an “inflow” of cash and therefore a positive adjustment. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

Step 3: Make sure every financial transaction has two components

In the double-entry system, transactions are recorded in terms of debits and credits. Since a debit in one account offsets a credit in another, the sum of all debits must equal the sum of all credits. The double-entry system of bookkeeping standardizes the accounting process and improves the accuracy of prepared financial statements, allowing for improved detection of errors. This is always the case except for when a business transaction only affects one side of the accounting equation.

There is a unique reporting structure, and, therefore, the records remain well-organized. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

Double Entry Accounting Example Calculation

The next activity should help you to understand the importance of both forms of the accounting equation. Therefore, to try to keep accurate accounting records, it is a good idea to reconcile your accounts regularly. Most companies today use accounting software, such as FreshBooks, Xero, or QuickBooks Online, and most accounting software uses a double-entry system. Debits will be recorded on the left side of an entry, and credits will be recorded on the right side of an entry. Also, considering the amount of accounting software available today, double-entry accounting is not nearly as difficult as it used to be. IT systems, vehicles, machinery and other assets sometimes come with hidden costs that exceed their purchase price. Learn Total Cost of Ownership Analysis from the premier on-line TCO article, expose the hidden costs in potential acquisitions, and be confident you are making sound purchase decisions.

Even so, the benefits of understanding the theory and process of double entry accounting can help you better understand how your business’s finances work. Single-entry bookkeeping is a record-keeping system where each transaction is recorded only once, in a single account.

The Balance sheet result is a “Net accounts receivable” less than the initial Accounts receivable value. Balance sheet extract with four contra asset line account entries for accumulated depreciation and allowance for doubtful accounts.highliging four Contra-asset account lines . A debit increases account balance in an Asset account, for instance, while a debit decreases account balance in a Revenue account.

For analysts, decision makers, planners, managers, project leaders—professionals aiming to master the art of “making the case” in real-world business today. Free AccessBusiness Case TemplatesReduce your case-building time by 70% or more.

Debits and Credits

For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase. Each individual’s unique needs should be considered when deciding on chosen products. The debits and credits for each individual transaction should add up to zero. The following journal entries will show what the above transactions would look like in a double-entry accounting system. Since transactions are recorded in two accounts, both effects of the transaction are shown. This is different than single-entry accounting, in which only expenses and revenue are tracked.

- By keeping the dollar amounts on each side equal, we ensure that we will also maintain the accounting equation, and assets will indeed equal liabilities plus equity.

- On the contrary, the latter is about making two entries simultaneously to two different accounts and marking both the debit and credit sides.

- Start with your existing cash balance for a given period, then add the income you receive and subtract your expenses.

- As with all rules, there are exceptions, but Marilyn’s reference to the accounting equation may help you to learn whether an account should be debited or credited.

- When the LIABILITY is increased as a result of a transaction, it will be credited.

- Expenses Account? The expenses account is all the expenses incurred by a company, such as the direct and indirect costs of operating, i.e. rent, electricity bills, employees, and salaries.

The software lets a business create custom accounts, like a “technology expense” account to record purchases of computers, printers, cell phones, etc. You can also connect your business bank account to make recording transactions easier.